Think you can beat the market? 📈

|

In this issue: Taking advice with a grain of salt, attempting to beat the market and finding fulfillment. "Working to help parents raise money-smart kids." 3 Ideas to Share & Save Hello, friends! I'm back from vacation. We visited Yellowstone for the first time, and it didn't disappoint. Otherworldly. Now onto this week's edition of "3 Ideas to Share & Save"! — 1 — Grains of Salt: Podcast guest Brad Klontz suggests we take personal advice with a grain of salt. I agree because, as the adage goes, "Personal finance is personal." For example, when I wrote this post about how much starter allowance we should give our kids, the amount was meant as a guideline, not as a hard-and-fast rule. In the short (two-ish minutes) video below, Mr. Stacking Benjamins, fellow podcast guest Joe Saul-Sehy, explains he wanted to optimize his allowance system for money experience (and the learning that comes from mistakes). So he doubled what I suggested in my post. Joe's thinking underscores a key tenet of The Art of Allowance Project. When we tap into our why, we can turn the program's resources and the ideas shared here into exactly what we need to enhance our money-smart journeys.

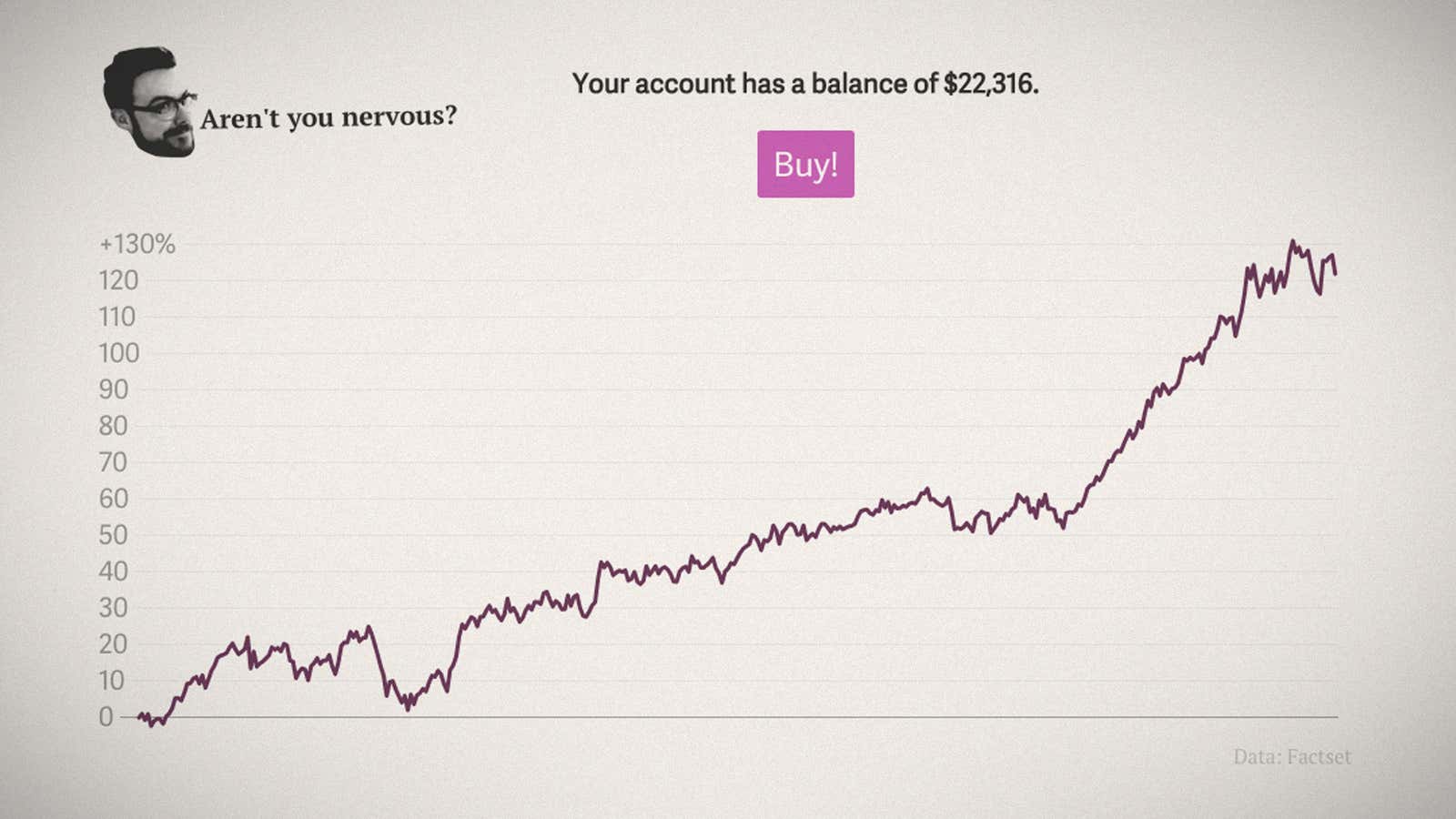

— 2 — The Next Munger: Think you can beat the market? Then give this short game a shot!

Were you able to do so? Yep, me too, once I got the hang of watching the trends and gained the benefit of a little hindsight. Of course, all I needed to do at that point was grab two moments in time: Sell high. Buy low. But hindsight biases us into thinking we have more control over events than we actually do. Missing from this game is the feeling of watching my own money being tossed about like a dinghy in a hurricane. When everyone around me is running with their hair on fire, will I really be strong enough to spot the opportunity to buy? Or to keep from throwing in the towel and selling in a trough? My lived experience and research on this topic tell me both scenarios are unlikely. The real lesson from this game is that the stock market is volatile in the short term but not so much in the long term. You almost certainly want to be in the market, but trying to time it is next to impossible. We all — myself included — want to believe we're above average in everything we do. And while there's a chance you or your child might be the next Charlie Munger, the odds are stacked against it. Hugely so. As JL Collins, author of The Simple Path to Wealth, writes, even the pros can't pick stocks. — 3 — Weekly Wisdom: "There is no such thing as objective wealth — everything is relative, and mostly relative to those around you."

- Morgan Housel from his new book, Same as Ever

Life is a process of figuring out what we want — what fulfills us. While these aspirations may change throughout our lives, one constant remains: Comparison is not fulfilling. Until next week, enjoy the journey! John, P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being.

View this email in your browser. Forwarded this email? Sign up here. |

3 Ideas to Share & Save

Every Monday I share 3 ideas to help you and your family on the money-smart journey. I created "The Money Mammals" for kids and wrote The Art of Allowance book for parents like you. Won't you join me on the money-smart journey?

In this issue: Engaging kids with money-smart messages, empowering parents with robust resources and making a contribution to society. "Working to help parents raise money-smart kids." 3 Ideas to Share & Save(Click the link above 👆 to read this week's edition on the web.) Hello, friends, I'd like to begin this installment of "3 Ideas to Share & Save" with a big thank you! 🙏 Our readership has doubled over the past several months due to your sharing these ideas and fellow writers' referring...

In this issue: Filling your money-smart rucksack, becoming a one percenter and considering perspectives on time. "Working to help parents raise money-smart kids." 3 Ideas to Share & Save(Click the link above 👆 to read this week's edition on the web.) Hello, friends! I've returned from dropping off my daughter at school, which means my wife and I are back to being empty nesters. But it also means I'm back to sharing this newsletter with you. So let's dive into this new installment! — 1 — Fill...

In this issue: Making financial literacy fun, avoiding distraction brokers and finding a rainbow. "Working to help parents raise money-smart kids." 3 Ideas to Share & Save(Click the link above 👆 to read this week's edition on the web.) Hello, friends! With so many kids simmering in schools before September, Labor Day no longer feels like the ceremonial end of summer. So this edition will wrap up the season in a neat, tidy (rain)bow. And since I'm helping my daughter start up her sophomore...